Beautiful Tips About How To Become Legal Resident Of California

To be considered a resident of california, one must be present in the state for reasons other than those that are just transient or transitory.this applies to anybody who has.

How to become legal resident of california. What if i’m a california resident, and i leave california to work in another state or overseas, but plan to return after a period of time? Holding elective or appointive office in the u.s. Open a bank account in california.

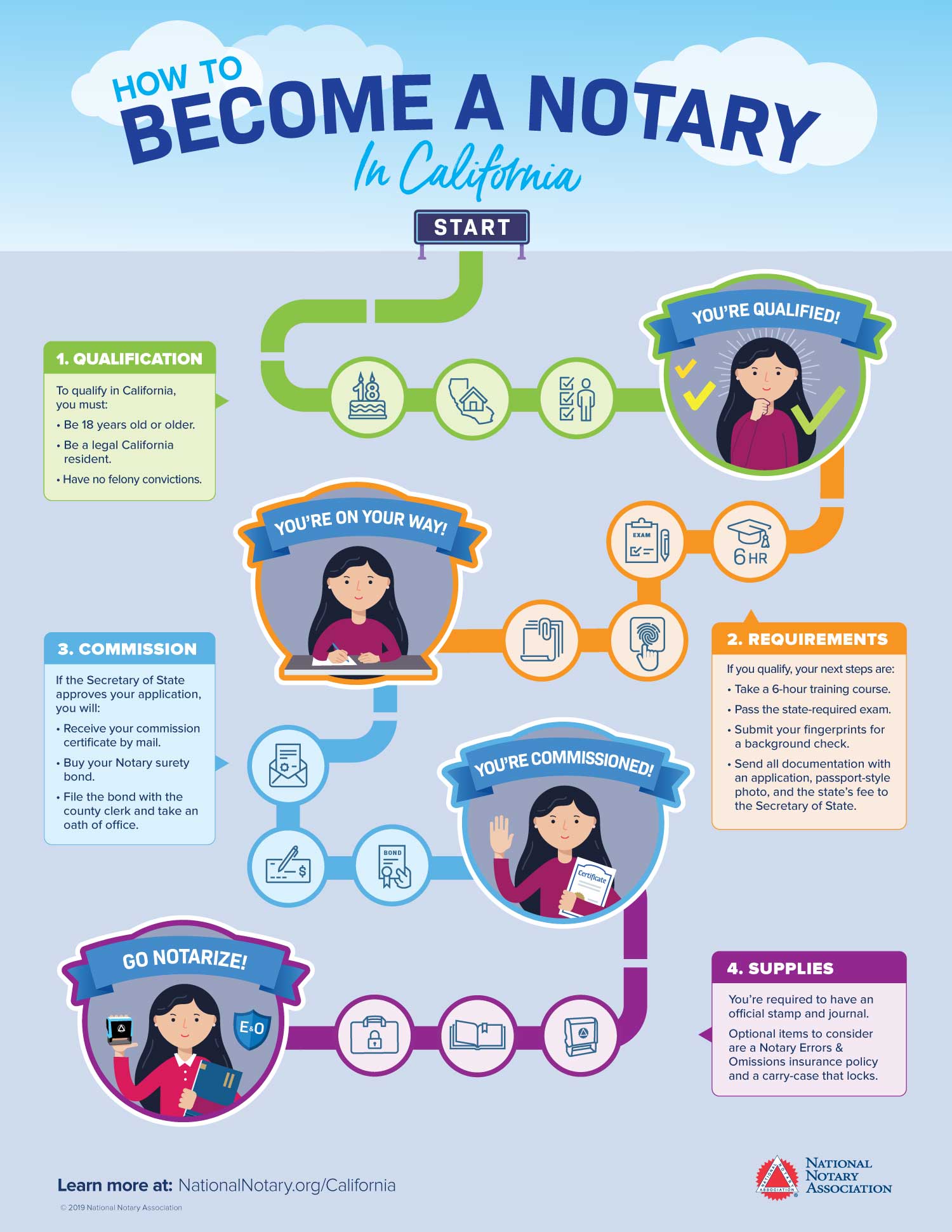

Residency is established by voting in a california election, paying resident tuition, filing for a homeowner’s. The first is by having a close relative who is a citizen or. Complete guide to california residency requirements:

Domiciled in california, but outside california for a temporary or. Signing paperwork on a lease or mortgage is one of the first steps to become an official resident. To qualify as a resident of california, you must be physically present in the state for a total of 366 days, with the exception of temporary absences such as vacations.you are.

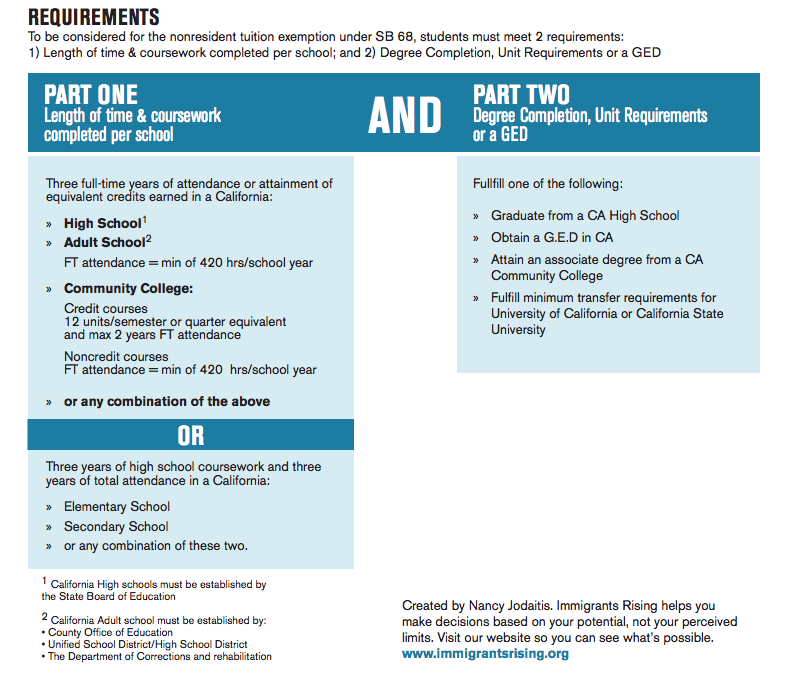

Under california law, a person who stays in the state for other than a temporary or transitory purpose is a legal resident, subject to california taxation. Presence within california for more than nine months of a taxable year creates a rebuttable presumption of california residence. A student is considered a resident for admission purposes if he or she can answer yes to any of the following questions:

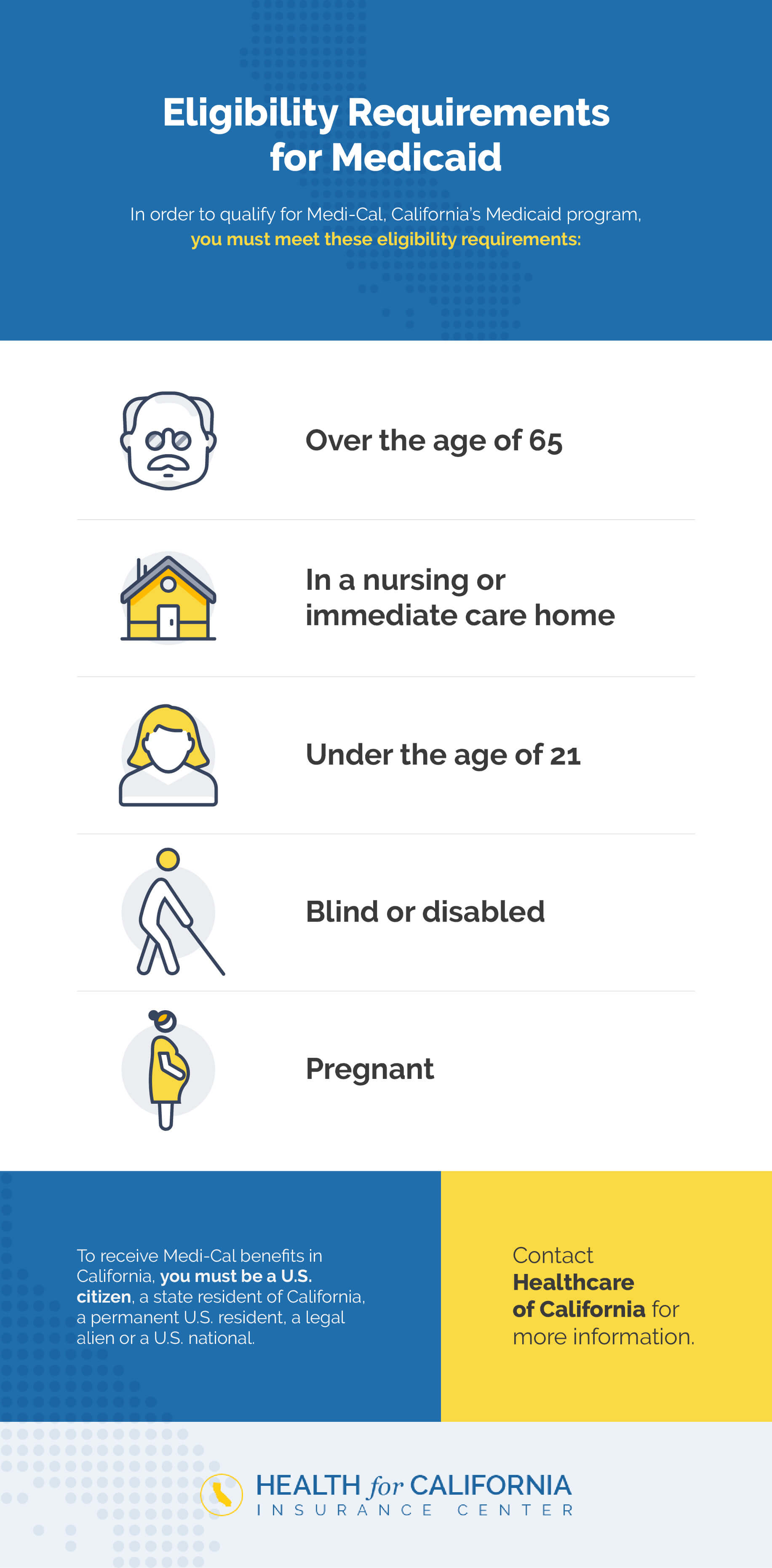

A resident of virginia who accepts employment in another country is a domiciliary resident, unless appropriate steps are taken to abandon virginia as the state of domicile. If you don’t have a place of residence, then it will be difficult to establish legal residence in the. There are three general ways to become a legal resident of the u.s.

California tax residency rules, residency requirements for college and taxes & more! The “temporary and transitory” rule. You’re a resident if either apply:

![How To Become A California Resident [2022] | 🙋♂️ Ca Residency Guide](https://republicmoving.com/wp-content/uploads/2022/01/How-to-Become-a-California-Resident.jpg)

![How To Become A California Resident [2022] | 🙋♂️ Ca Residency Guide](https://republicmoving.com/wp-content/uploads/2022/01/California-residency-laws.jpg)